Automated IFRS 9 Compliance Solution With Precision And Security

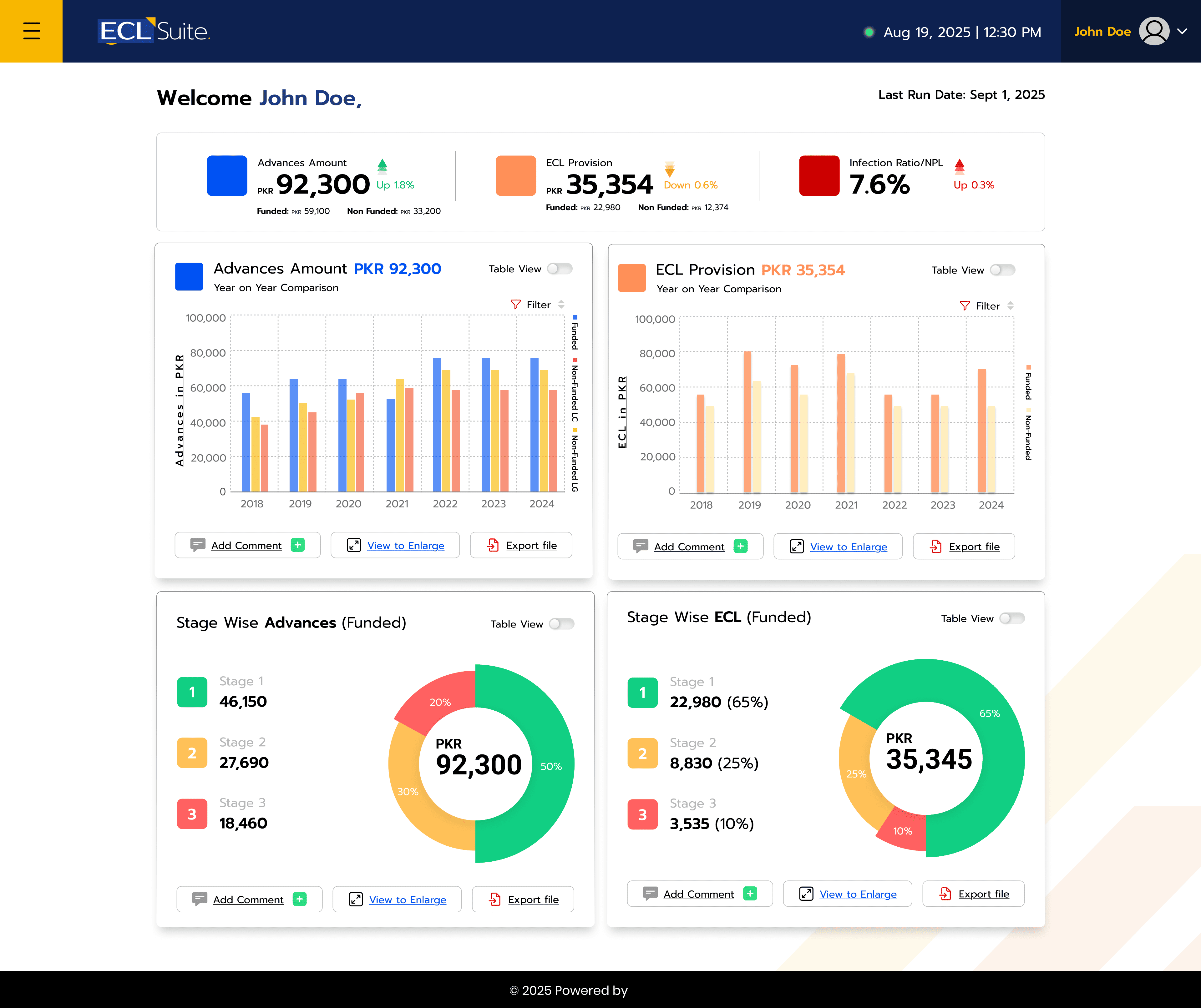

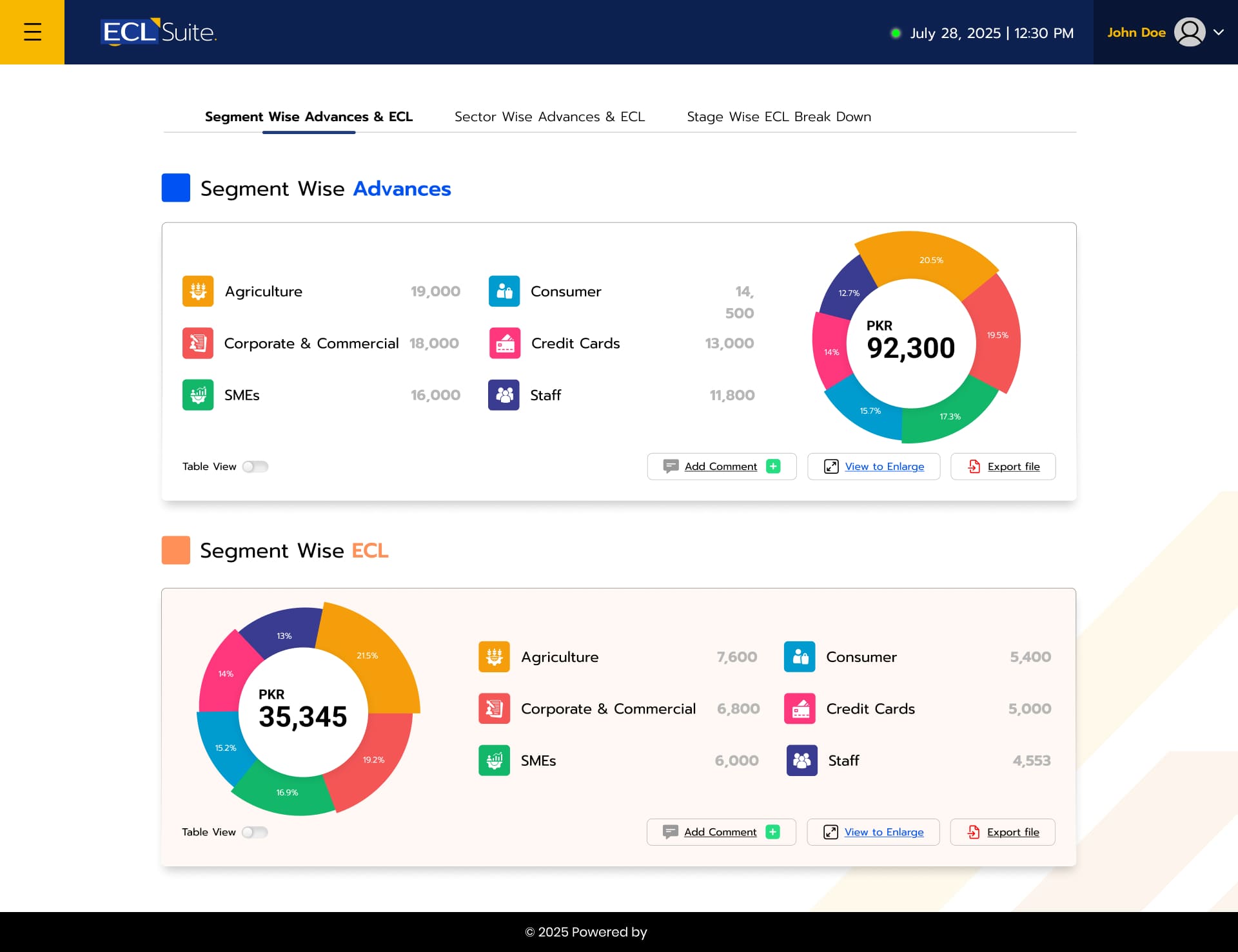

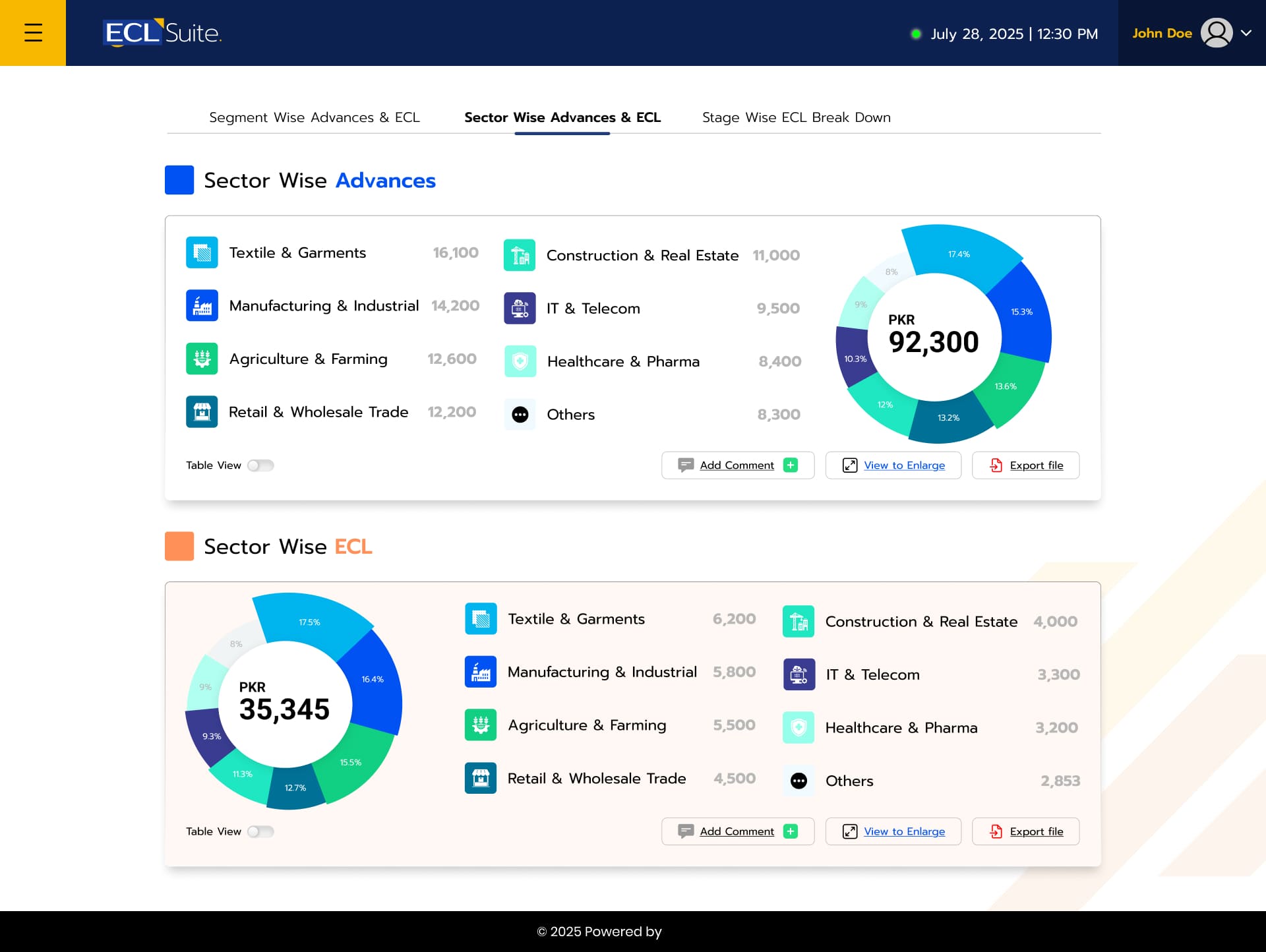

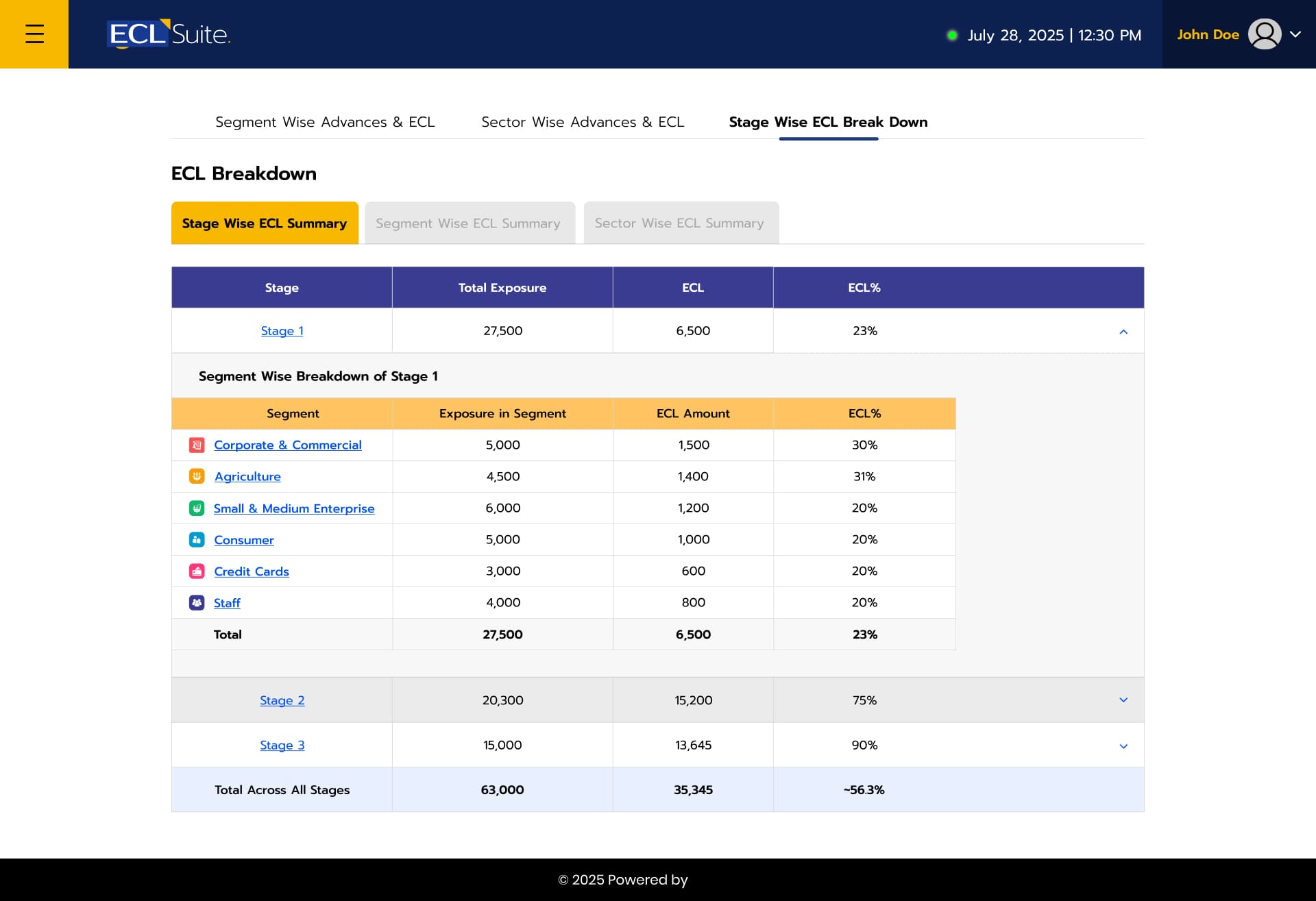

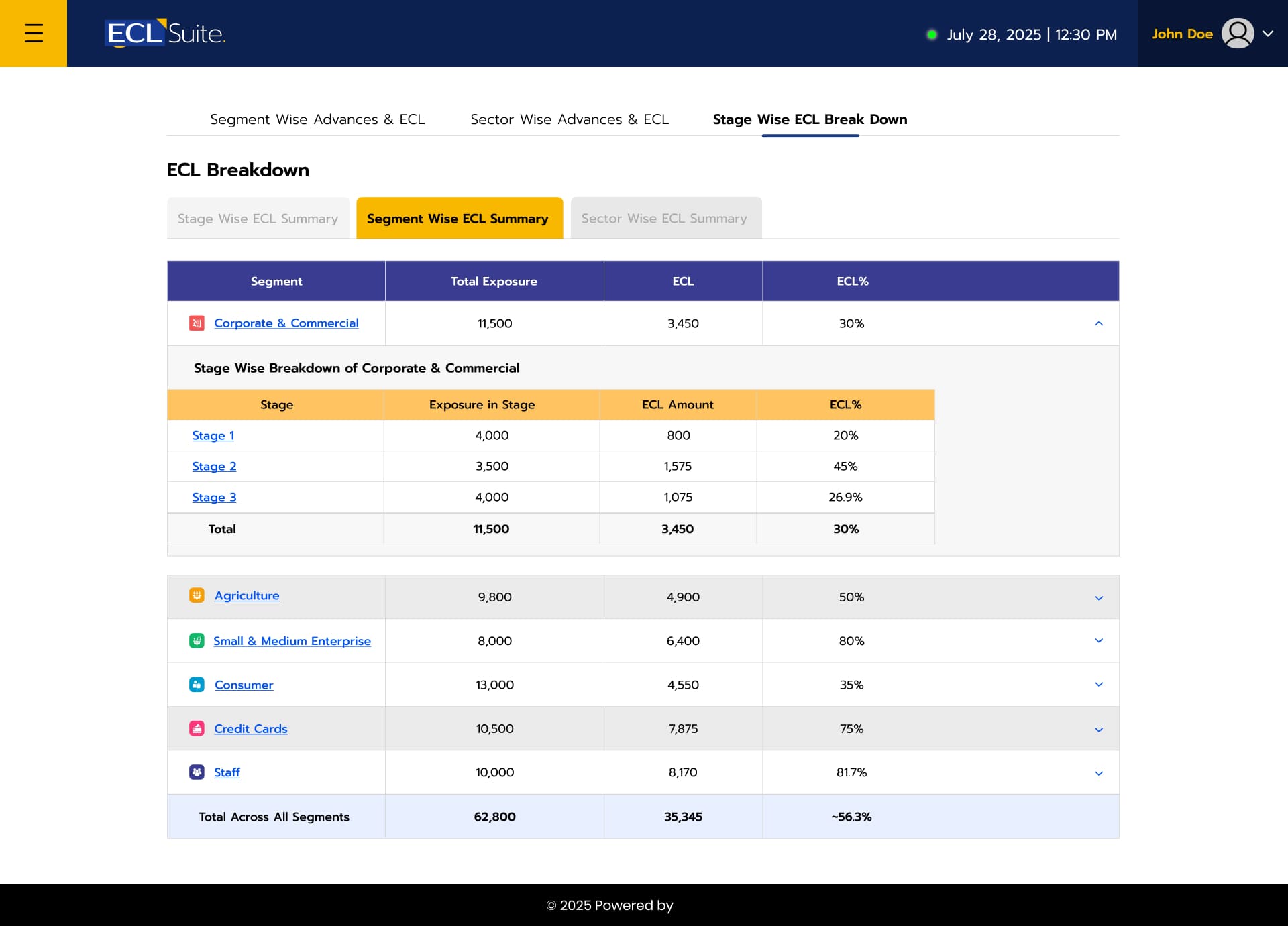

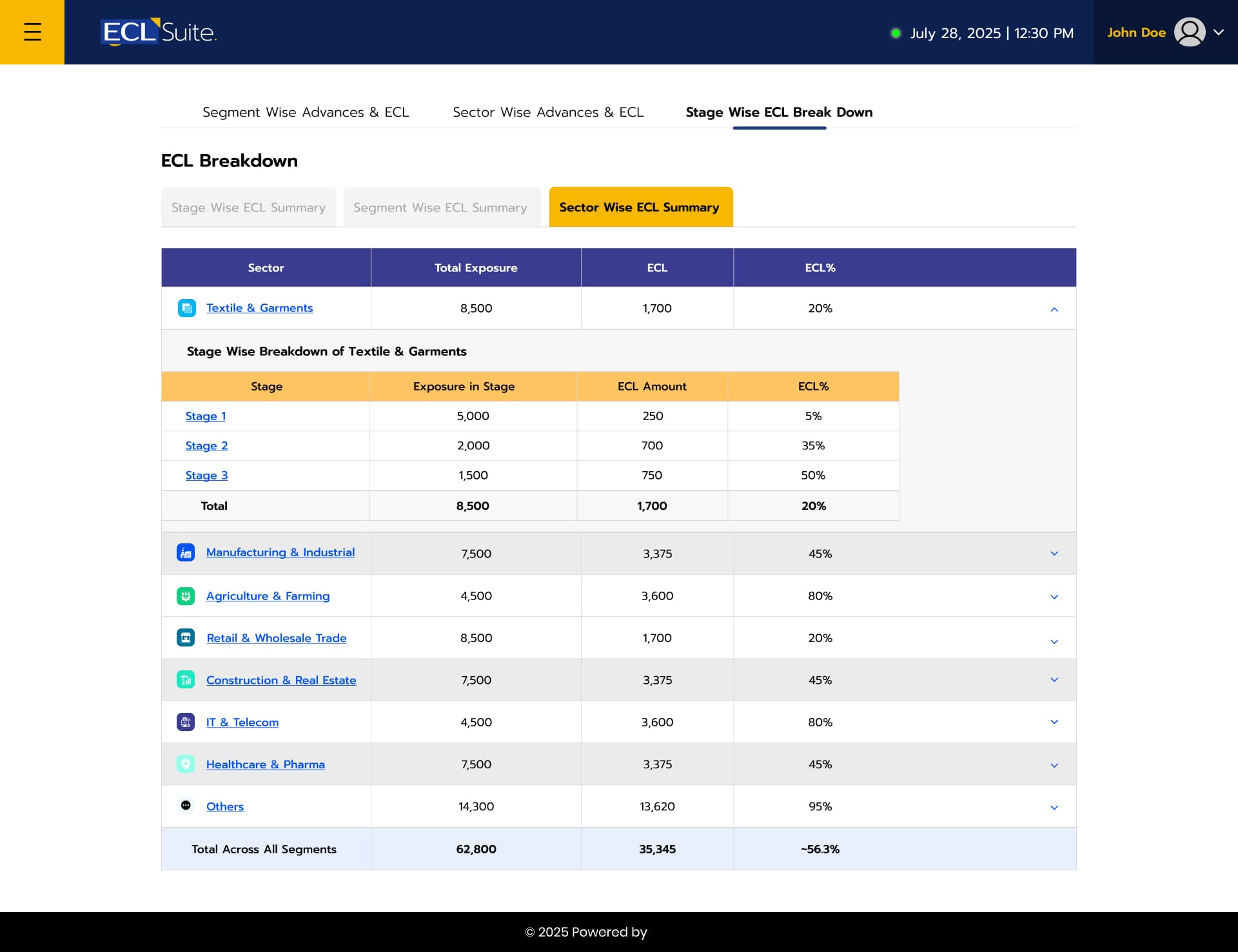

Astrik ECL Suite is a comprehensive, Data Modeling ECL solution designed for banks, lending institutions, and financial enterprises to automate Expected Credit Loss (ECL) calculations and regulatory reporting under IFRS 9 — reducing risk, boosting accuracy, and saving valuable time.

Unlike manual Excel models or siloed systems, ECL Suite centralizes your credit risk workflows with automation, transparency, and enterprise‑grade security — all in one intelligent software solution.

SOC 2 Certified

Enterprise-Level Security

100% Uptime